What is the Treasury Offset Program?

Individuals, businesses, states, and other entities may owe money to the federal government. That's a debt.

If they don't pay the debt on time, it becomes overdue (delinquent). When the debt is overdue, the Treasury Offset Program (TOP) helps collect the debt by holding back money from a federal payment to the debtor. (Holding back money from a payment is call "offsetting the payment" or "administrative offset.")

For example, if you have a delinquent debt for a federal loan, TOP can reduce your federal tax refund or social security benefit payment to pay that debt.

TOP may offset many types of federal payments to collect delinquent debt. There are some payments that are not offset through TOP. See the TOP Payment Exemption Chart.

What happens before agencies send debts to TOP?

The agency must send a letter to the debtor at the name and address on file for the debt at least 60 days before sending the debt to TOP. The letter must tell the debtor about the debt (type and amount), that the agency intends to refer the debt for offset, and what rights the debtor has to resolve the debt situation. The letter must give the debtor opportunities to pay the debt, enter into a payment agreement, or dispute that they owe the money to the agency.

How TOP Works

Sending information about overdue debts to TOP

The law requires agencies to send debts to TOP when the debt is 120 days overdue.

The agency must make sure the debt is valid and legally enforceable.

Information about the overdue debt includes the debtor's taxpayer identification number (TIN). For an individual, that's usually a Social Security Number (SSN). For a business, nonprofit organization, or state agency, that's usually a Federal Employer Identification Number (FEIN).

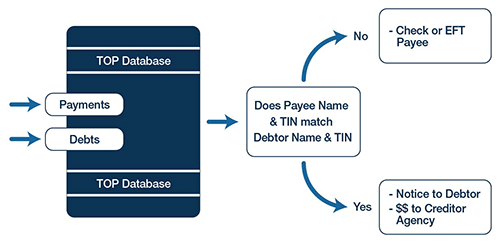

Matching payments and overdue debts

When an agency is about to pay a person, business, state, or other entity, they fill out a payment voucher, which includes the name and TIN of the payee. These agencies are called payment agencies.

The Bureau of the Fiscal Service (of which TOP is part) actually makes the payments on behalf of most agencies. Other agencies (for example, the US Postal Service) are responsible for their own payments. The people who send payments are called "disbursing officials."

Before sending a payment, disbursing officials use the TOP database to compare payees and debtors.

A payment is reduced (offset) to pay an overdue debt if these two criteria are met:

- Information about the payee's name and TIN match with information about the debtor in the TOP database.

- The payment is a type that can be offset.

Sending payments and letters to the payee

If there is no match, the payee gets the entire payment.

If there is a match, the offset reduces the payment in whole or in part, to satisfy the debt, to the extent allowed by law. If money remains in the payment after it is offset, the reduced payment goes to the payee.

If the payment is offset, we send a letter explaining why the payment is less than they expected or that the entire expected payment went to satisfy their overdue debt.

Giving the debt money to the right agency

TOP sends the offset amount to the agency to which the debt is owed.

When does a debtor leave the TOP database?

A debtor stays in the TOP database until the agency that sent the debt to the TOP database tells TOP to stop collecting the debt.

The agency might tell TOP to stop collecting if the debt has been paid in full, if the debt is subject to a bankruptcy stay, or if other reasons justify pausing or stopping collection.

What laws and rules govern TOP's work?

See also TOP Legal Authorities Quick Reference.

We also have a one-page fact sheet that summarizes the general rules applicable to TOP, requirements for due process, amounts that can be offset for different types of debts, and exemptions (payments that cannot be offset): Summary of TOP's Program Rules and Requirements.